nikkeisindex

Email Address: pneumatic_arse-bludgeon@gunston.com

Posts: 407  Member is Online

Member is Online

|

Post by nikkeisindex on May 29, 2023 1:22:49 GMT

The internet, 9/11, coronavirus, and now AI.

Calm down, people, I don't need all this shit.

Just let me do the same easy thing for ever and wake up thinking about what's for lunch.

AI this AI that AI job reinvent yourself.

I like change, I thought going to live in Japan was great fun, okay, now that's enough. No more radically permanent resets or shifts in perspective.

At least slow down. If I'm 60 and I'm supposed to relearn any significant function of daily life I'm going to be seriously pissed.

|

|

|

|

Post by Sprague Dawley on May 29, 2023 4:56:42 GMT

Shit is about to get seriously embarrassing for me. Not only am I getting left behind technologically, I am about to be lapped. My lack of shartphonery is soon going to see me unable to function in ill futurii societii.

|

|

|

|

Post by Ladyfingers on May 29, 2023 5:26:33 GMT

I don't mind technological change as much as I hate how lame everything has gotten. Everyone's so fucking sensitive and you can't have a fucking discussion without someone doing that bitch move of rolling their eyes and saying "o-o-okay" when you express dissent.

|

|

fuckface

will gargle nuts for more nuts

hey there

Posts: 614

|

Post by fuckface on May 29, 2023 6:42:07 GMT

The internet, 9/11, coronavirus, and now AI. Calm down, people, I don't need all this shit. Just let me do the same easy thing for ever and wake up thinking about what's for lunch. AI this AI that AI job reinvent yourself. I like change, I thought going to live in Japan was great fun, okay, now that's enough. No more radically permanent resets or shifts in perspective. At least slow down. If I'm 60 and I'm supposed to relearn any significant function of daily life I'm going to be seriously pissed. tell me about it, i fucking am 60. truthfully, i just let that stuff wash over me like a grey misty rain day. while vaguely annoying, once you start complaining about it, you're on a slippery slope to the nearest aged care facility with a bunch of poorly informed over opinionated yesterdays hero's, all shouting over each other at the 6 o'clock news. oh well, in the words of the grate doris day >>> Qué será será Whatever will be, will be The future's not ours to see Qué será, será What will be, will be. |

|

|

|

Post by sukebegg on May 29, 2023 12:31:49 GMT

AI? oh just the wave we floating on right now...Wait until Meta really kicks off. Haha. AI is the only thing blowing up the tech world software wise. Can it be combined with Quantum Computing to really uhmmmmm immanentize the eschaton ? No, that's not it... "The technological singularity—or simply the singularity—is a hypothetical future point in time at which technological growth becomes uncontrollable and irreversible, resulting in unforeseeable changes to human civilization." Singularity, complete connectivity...generalized telepathic abilities...who knows what fun awaits us in the New Age...misnomered as the New Normal. Something to consider is that there really haven't been any new technologies for the last 30 years. End-ternnet. (VR is just an amalgamation of other tech) Ran across this cool old clip about AI You never hear much about Nanotech but this is a great (brief) essay about it from 1959. I don't F with science much but Feynman's autobio is a really fun read (he worked on the A-bomb but left part way through). www.zyvex.com/nanotech/feynman.html |

|

|

|

Post by Sprague Dawley on Jul 10, 2023 3:13:59 GMT

|

|

|

|

Post by Sprague Dawley on Aug 1, 2023 10:51:31 GMT

Oh shit. Another paradigm shift. Some nerd cunts getting a colossal stiffy about "room temperature superconductors". Whatever the fuck that means. I think it boils down to my computer in the future won't overheat when I watch too much grot on a hot day.  |

|

|

|

Post by sukebegg on Aug 1, 2023 15:52:36 GMT

haha I ran across that same thread somehow and tried to read it...cold fusion maybe? Quantum nano-computer cold fusion with a dash of quarks from the mega-super-duper-collider?

A sex doll with the most realistic manko known to man? That would be more useful in this day and age...

The next step in technology will have to be a leap beyond our current capability to imagine.

|

|

|

|

Post by Sprague Dawley on Aug 2, 2023 0:51:12 GMT

I heard Mrs Forthreich will paradigm shift and quantum nano-computer cold fuse your ballsack with a dash of quark all up and down your mega-super-duper-collider power shaft.

|

|

|

|

Post by sukebegg on Aug 7, 2023 17:06:14 GMT

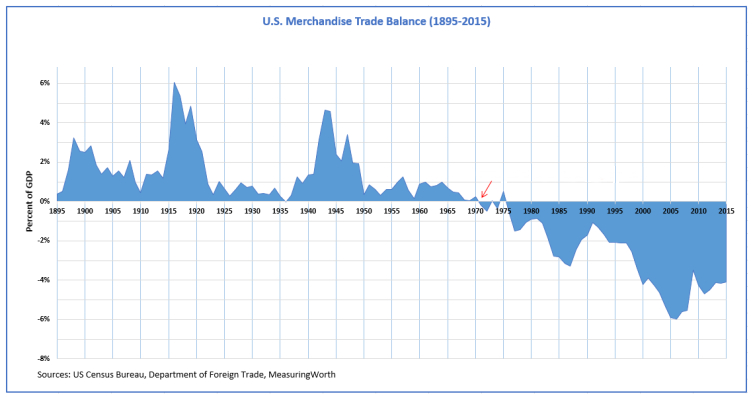

Part of the paradigm shift will be the consequences of all the charts on the page below. What happened in 1971? Of course, the US dumped the gold standard and started to vacuum up the world with the free-printing dollar and a whole lot more...There's a twitter with lots of discussion and criticism but most of these are pretty cold hard fax... wtfhappenedin1971.com/   That one's a real crowd pleaser - note how the debt goes from 6 trillion in 2000 to the current 23 trillion. Everything's fine.  Return of the Oligarchs and gangsters.  So, this C-L index is: The Coleman-Liau index is a readability formula that uses the number of characters per word and the number of words per sentence to estimate the U.S. grade level necessary to understand a text. It was developed by Meri Coleman and T. L. Liau in 1975. Index | Grade level - | -- 0-3 | 1st-2nd grade 3-5 | 3rd-4th grade 5-7 | 5th-6th grade 7-9 | 7th-8th grade 9-12 | 9th-12th grade 12+ | College So, politicians on both sides got to 7th-8th grade level and then found it easier to back off...Googling I ran across a random google drive file but it shows Trump at 7.7, lowest in modern history. Obama and Carter with solid elevens - still 7th-8th grade level. The above is an average and you would expect the president to be an outlier with all those historic speech moments and whatnot...Oh JFK rocking a 10. I seem to remember reading the PT 109 book around 7th grade. Different times - "and with the strap, between his teeth..." I'm looking at you Mr. RFK jr. (also notable for "...the enemy...the heathen gods of old Japan" |

|

|

|

Post by Sprague Dawley on Aug 7, 2023 20:16:38 GMT

That one's a real crowd pleaser - note how the debt goes from 6 trillion in 2000 to the current 23 trillion. Everything's fine. I cant really fathom how this works. Debt means there's a loan involved? "But you guyz will pay us back the 23 trill, right? Right?

"Uhh, we're a bit short this week. Maybe next week....." |

|

|

|

Post by sukebegg on Aug 8, 2023 10:10:36 GMT

Loans in the form of government bonds.

AI says:

The U.S. national debt is the amount of money that the federal government owes to its creditors. It is the accumulation of all the money that the government has borrowed over time to cover its budget deficits.

A budget deficit occurs when the government spends more money than it collects in taxes and other revenue. To finance its budget deficit, the government borrows money by selling debt securities to investors. These debt securities are known as Treasury bills, notes, and bonds.

The national debt is the total amount of money that the government owes to the holders of these Treasury securities. It is a constantly growing number, as the government continues to borrow money to cover its budget deficits.

The interest payments on the national debt are a significant expense for the federal government. In 2022, the government spent $476 billion on net interest costs on the national debt. This is more than the government spends on education or national defense.

****

So bond holders also collect interest payments, further driving up the debt. It's an exponential world.

|

|

|

|

Post by Sprague Dawley on Aug 8, 2023 10:43:35 GMT

Loans in the form of government bonds. AI says: The U.S. national debt is the amount of money that the federal government owes to its creditors. It is the accumulation of all the money that the government has borrowed over time to cover its budget deficits. A budget deficit occurs when the government spends more money than it collects in taxes and other revenue. To finance its budget deficit, the government borrows money by selling debt securities to investors. These debt securities are known as Treasury bills, notes, and bonds. The national debt is the total amount of money that the government owes to the holders of these Treasury securities. It is a constantly growing number, as the government continues to borrow money to cover its budget deficits. The interest payments on the national debt are a significant expense for the federal government. In 2022, the government spent $476 billion on net interest costs on the national debt. This is more than the government spends on education or national defense. **** So bond holders also collect interest payments, further driving up the debt. It's an exponential world.  "I see many words yet I do not see repayment "I see many words yet I do not see repayment

of my organisation's loan. You still do not seem

to grasp the full meaning of this word 'loan'......" |

|

|

|

Post by sukebegg on Aug 8, 2023 11:48:15 GMT

It's just the AI response to "what happens if us treasury holders cash in?" Add "+china" for more fun! {Spoiler}

If US Treasury holders cash in, the US government will have to find a way to pay them back. If the government does not have enough money to pay back all of its creditors, it will default on its debt. This would have a devastating impact on the US economy and financial markets.

Here are some of the things that would happen if the US government defaulted on its debt:

Interest rates would skyrocket, making it more expensive for businesses to borrow money and invest.

-This would lead to slower economic growth.

The value of the US dollar would decline, making it more expensive for Americans to buy imported goods.

- This would also lead to higher prices for consumers.

Investors would lose confidence in the US government, making it more difficult for the government to borrow money in the future.

- This would make it harder for the government to fund its operations and pay for its programs.

The US economy could enter a recession, with high unemployment and falling wages.

A US debt default would be a major crisis, with far-reaching consequences for the US economy and the global economy. It is important to note that the US government has never defaulted on its debt, and it is unlikely to do so in the near future. However, the possibility of a default is always a risk, and it is something that investors and policymakers need to be aware of.

In addition to the economic consequences, a US debt default would also have a significant impact on the global financial system. The US Treasury market is the largest and most liquid debt market in the world, and it is used by central banks and other financial institutions to manage their reserves. If the US government defaulted on its debt, it would shake confidence in the global financial system and could lead to a financial crisis.

It is important to remember that a US debt default is not inevitable. The US government has a long history of paying its debts, and it has the resources to do so even if it has to raise taxes or cut spending. However, the possibility of a default is a risk that should not be taken lightly. |

|

|

|

Post by Sprague Dawley on Aug 8, 2023 12:25:48 GMT

The value of the US dollar would decline  I got wholesale orders ready to go from Relapse, Midheaven and Cobraside would you cunts just default already ffs |

|